FINANCIAL PLANNING

FINANCIAL PLANNING

We require no account or net-worth minimums

Comprehensive financial plans personalized to your unique situation

Access to your Personal Financial Website to streamline planning & implementation

Packages to cover all planning needs

Periodic updates & reviews to provide ongoing support

Recommendations of adjustments needed to accomplish your financial goals

Clear summary of next steps to implement your plan

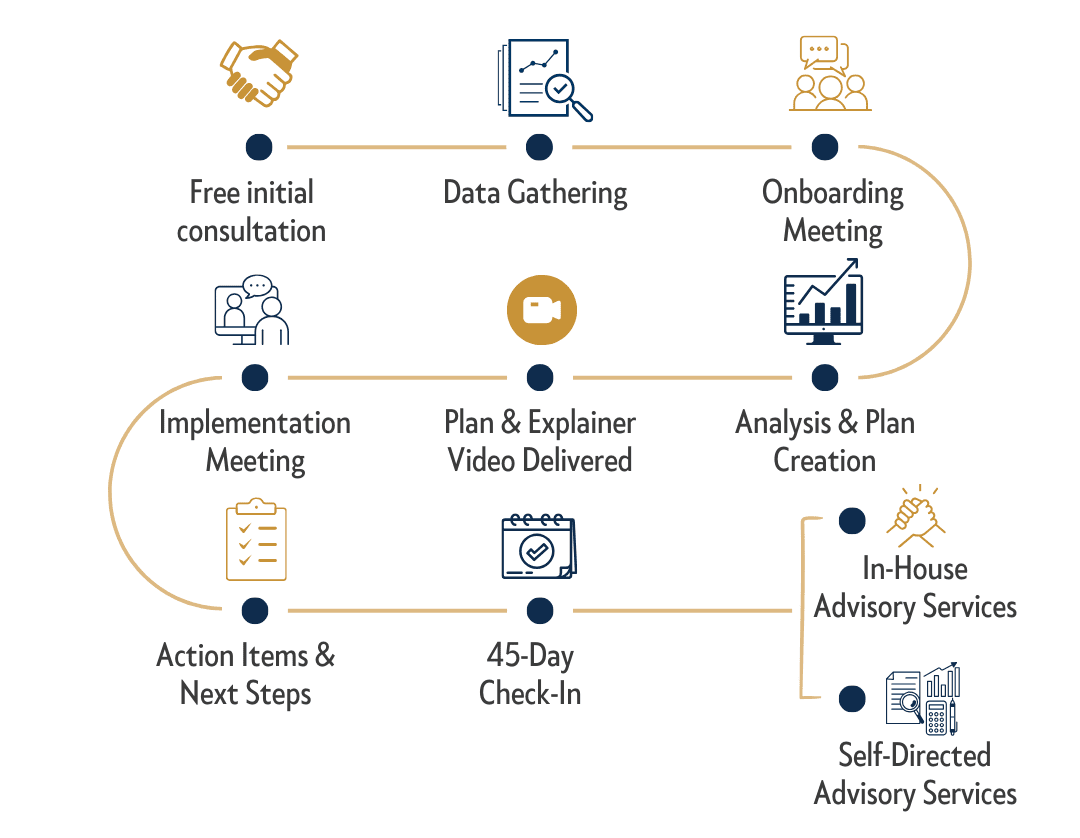

Financial Planning Process

How we work with you to build a comprehensive financial plan.

We will discuss your current situation & goals & explain our services, process, & pricing.

Upon engaging our services, we begin collecting the detailed financial information we need to begin building your baseline reports. (At this stage, it is important we receive all requested information so we can most effectively begin constructing your plan.)

Once we have reviewed the initial documents, we schedule a in-depth meeting with you to gather any final details or information needed to complete your plan.

Now that we have all the information we need about your goals and current situation, we create your plan.

When the plan is completed, we provide you a copy of the plan along with an explainer video outlining the plan and our recommendations.

After you have watched your explainer video, we schedule a meeting to discuss in detail any questions you have about the plan or implementation.

For 45 days following your implementation meeting, we are available to assist you with completing your action steps to implement our recommendations.

In this final meeting, we check on the status of your progress in implementing your plan.

If you need additional assistance or want further ongoing support, we offer the option for continued fee-based or asset management services.

Financial Plan Pricing

Every client receives the Baseline package. Additional needs are priced a' la carte.

Baseline Financial Plan

$3,000

- Cash Flow Analysis

- Net Worth Analysis

-

Retirement Planning

Recommendations regarding types of accounts & funding levels

-

Retirement Distribution Planning

Includes Social Security & Required Minimum Distribution recommendations

-

Risk Management Analysis

Gap analysis for premature death, disability, & long-term care. Estate Planning needs summary.

-

Investment Allocation

Corporate retirement plan review. Recommendations for reallocation at current investment institutions

Additional Planning Areas

A' La Carte

- Single Property Purchase/Sale Scenario - $350

- Multiple Property Cash Flow Analysis - $250/property

- Cost of Living/Relocation Analysis - $250/location

- College Planning - $100/child

- Debt/Liability Planning - $350

- Stock Compensation Planning - $675/plan

- Roth Conversion Planning - $200/account

- Estate & Gift Planning - $500

- Business Retirement Integration Planning - $1,500